Healthcare Investment in India

The e-health market size is estimated to reach US$ 10.6 billion by 2025.

Overview

The Indian healthcare sector is witnessing major adoption of digital technologies, could be credited to the COVID-19 pandemic. The daily use of telehealth, wearable devices, health apps, adoption of Electronic Health Records, Artificial intelligence (AI) and Machine Learning (ML) has seen a significant rise in past couple of years.

In a recent report it is revealed that the digital healthcare market in India was valued at Rs. 252.92 Billion in FY 2021 and is expected to reach Rs. 882.79 Billion by FY 2027, expanding at a CAGR of 21.36% during the FY 2022 - FY 2027 period. The e-health market size is estimated to reach US$ 10.6 billion by 2025.

Investments Opportunity

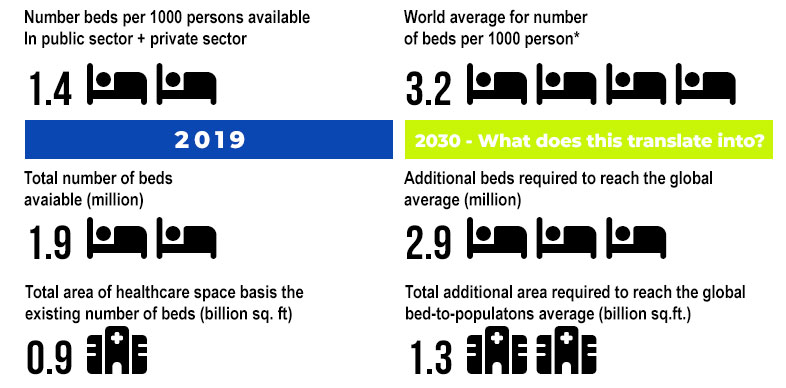

FDI inflow for the drugs and pharmaceuticals sector stood at US$ 19.90 billion. As of July 2022, the number medical colleges in India stood at 612. India is a land full of opportunities for companies in the medical devices. Catering to a second largest population of the world, India has also become one of the leading destinations for high-end diagnostic services with tremendous capital investment for advanced diagnostic facilities.

Besides, rising income levels, an ageing population, growing health awareness and a changing attitude towards preventive healthcare is expected to boost healthcare services demand in the future. Deeper penetration of health insurance aided the rise in healthcare spending, a trend likely to intensify in the coming decade.

Why KAIRNE

Kairne sees that there is a significant potential for growth in Tier 2 and Tier 3 locations in India, even though these Tier 2 and Tier 3 towns have a considerable number of primary healthcare centers, they lack quality healthcare services and they can serve as quality healthcare units to the nearby smaller villages and towns.

Kairne intends to acquire hospital where hospitals are owned by trusts and managed by hospital management companies may lead to certain concerns from an investment perspective.

Interested in Indian healthcare business

Complete the form below, and our team will contact you or write us a mail contact@kairne.in