Alternate Investment Funds (AIF's)

KAIRNE offers category 2 debt AIF's

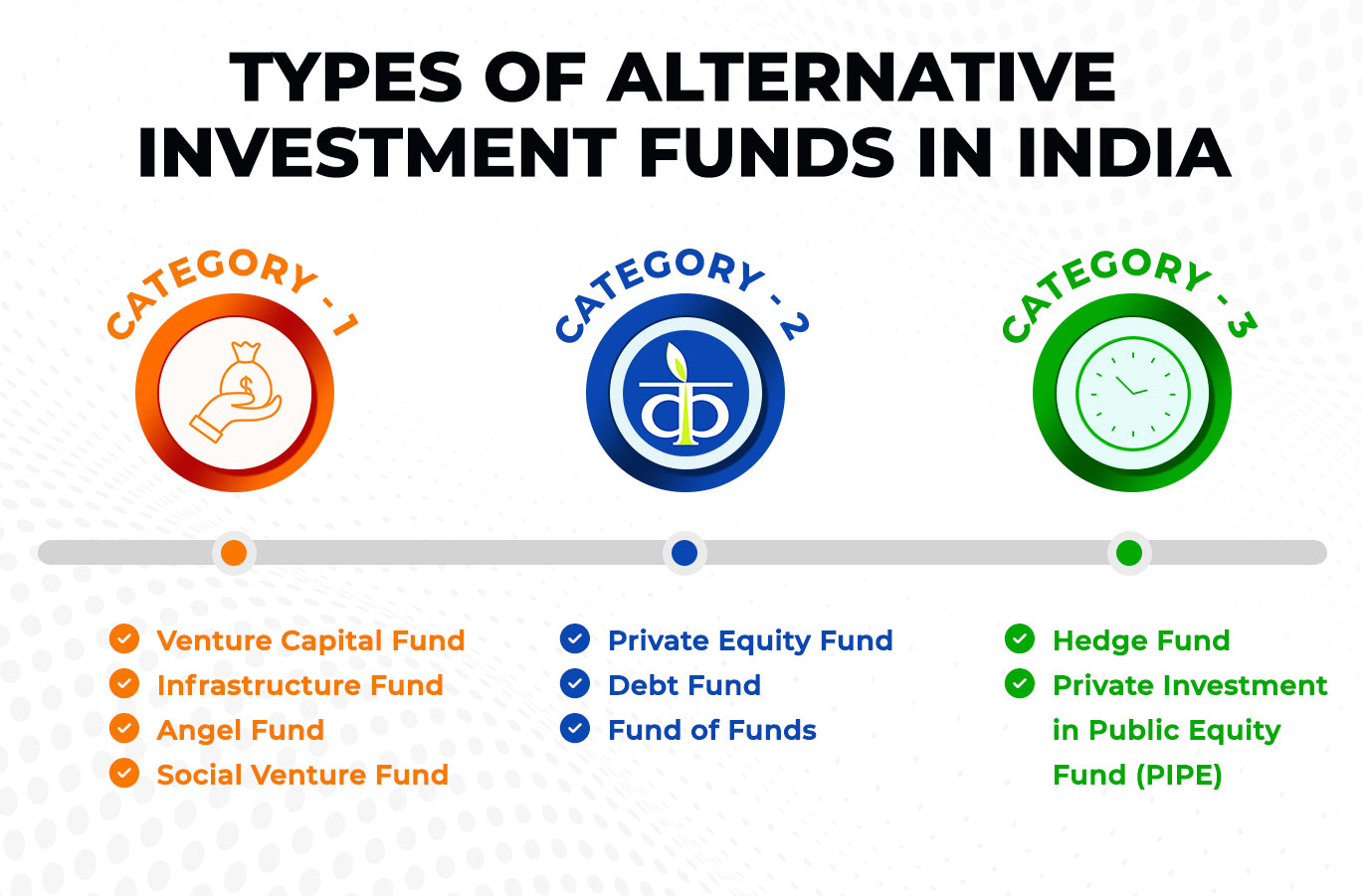

Aligned with global financial guidelines, AIF investments are done under the debt securities, and it is believes the fund follow good governance models and have good growth potential. AIF is a privately pooled investment vehicle, the amount contributed by the investors is not used for purpose of giving loans. AIF does not include funds that are included in the regulations of the IFSC which oversee fund management activities. Other exemptions include family trusts; employee welfare trusts or gratuity trusts.

Working of AIF's

AIF is generally invested in new start-ups that do not receive investments from Venture capital funds. Each angel fund investor and social venture fund generally allocates minimum funding put their money in businesses that take part in philanthropic activities.

Tenure of AIF's

For AIF, the tenure shall be determined at the time of application and shall be for minimum three years.

What are the benefits of AIF investments?

Security against instability

Investing in AIF is a great way to protect investments from volatility and stabilize portfolio. Under these formats, AIFs do not put their funds in investment options that trade publicly, hence, they are not related to open markets and do not fluctuate with high and lows.

Excellent portfolio diversification

AIF's allocate funds to wide array of assets that are significantly more than most other investment vehicles. Hence, they provide excellent portfolio diversification that can safeguard investments in times of market volatility or financial crisis.

Profitable returns

AIF investment returns are profitable as these funds have numerous investment options. They are great reliable source of passive income as compared to conventional investment methods.

High return and tax benefits

AIF's generally have a higher and better return potential than several other investment options. The massive pooled amount collected gives the fund managers enough opportunity to prepare flexible strategies for maximizing returns on investment

Low volatility

AIF's do not directly related to stock markets, hence volatility in these funds is very less. So it become suitable for risk- averse investors looking for stability

Diversification

AIF's allow much-needed diversification in an investment portfolio. They act as a cushion at the time of a financial crisis or market volatility

Reducing volatility

AIFs may help in reducing volatility that is commonly associated with traditional investments as their performances are not dependent on the ups and downs of a stock market.

Diversification

Helps in diversification in terms of markets strategies and investment styles.

Improving performance

Strong potential in improving performance

Who Can Invest

KAIRNE offers easy investment oppurtunity in AIF

Investors who are willing to diversify their portfolio can invest in AIFs.

Following are the eligibility criteria:

- Resident Indians, NRIs, foreign nationals can invest in these funds

- The minimum investment limit is ₹. 1 crore for investors, whereas the minimum investment amount for directors, employees, and fund managers are ₹. 25 lakh

- AIF's come with a minimum lock-in period of three years

- The number of investors in every scheme is restricted to 1000, except angel funds. Where the number of investors goes up to 49

Interested in AIF

Complete the form below, and our team will contact you.